Artificial Intelligence (AI) is reshaping industries across the globe, and the financial sector is no exception, especially in finance automation. PwC reports that 85% of financial companies are implementing AI to streamline their financial process.

From automating routine tasks to enhancing decision-making capabilities, AI is ushering in a new era of efficiency and innovation in finance. As financial institutions adopt AI technologies, they discover benefits that streamline operations, cut costs, and improve accuracy.

In this blog post, we delve into the myriad ways AI is revolutionizing financial processes. We explore the tangible benefits that AI brings to the table, from automating mundane tasks to providing advanced analytics and insights.

Additionally, we will address the challenges that come with implementing AI in finance, ensuring you have a comprehensive understanding of both the opportunities and the hurdles.

Join us as we navigate the exciting landscape of AI in finance, uncovering the innovations that are driving the industry forward and the critical considerations for successful AI integration.

Introduction to AI in Finance Automation

Artificial Intelligence (AI) automation refers to the deployment of AI technologies to perform tasks traditionally requiring human intelligence. These tasks cover a range of activities, from complex calculations and data processing to understanding natural language and solving intricate problems.

In the financial sector, AI automation aims to streamline operations, reduce the need for manual intervention, and significantly enhance accuracy and speed.

Key Technologies Driving AI in Finance Automation

Several advanced technologies enable AI automation, each offering distinct capabilities that can be leveraged to optimize financial processes:

- Robotic Process Automation (RPA): RPA uses software robots or “bots” to automate repetitive tasks. It can handle tasks such as data entry, transaction processing, and report generation with high efficiency.

- Natural Language Processing (NLP): NLP enables machines to understand and interpret human language. In finance, NLP is used for sentiment analysis, customer service chatbots, and automated document management.

- Machine Learning (ML): ML algorithms analyze historical data to make predictions and decisions without being explicitly programmed for specific tasks. It’s widely used in risk management, fraud detection, and investment analysis.

Why Financial Services Need AI Automation?

The financial services industry is characterized by vast amounts of data and highly complex processes. Here are key reasons why AI automation is essential:

- Efficiency: AI can process large volumes of data faster than humans, reducing time and cost.

- Accuracy: AI reduces the risk of human error, ensuring more accurate financial reporting and analysis.

- Scalability: AI can handle increasing amounts of data and transactions as businesses grow.

- Compliance: AI helps ensure adherence to regulatory requirements by automating compliance checks and generating audit trails.

Use Cases & Best Practices in Finance Automation

Despite process challenges, 80% of finance leaders have implemented or plan to implement RPA. However, only 15% have been able to scale AI. Some key use cases and best practices for AI in finance:

AI & Risk Management

AI technologies make risk management more proactive and precise. Machine learning models analyze historical data to predict potential risks, enabling financial institutions to take preventive measures. AI can also monitor market trends and economic indicators in real time, providing insights into emerging risks.

AI & Fraud Prevention

Fraud prevention is critical in the financial sector. AI can detect unusual patterns and anomalies in transactions that may indicate fraud. Machine learning algorithms continuously learn from new data, improving their ability to identify fraudulent activities over time. Techniques like anomaly detection and behavioral analysis play a significant role in minimizing fraud.

AI & Trading

AI-driven trading algorithms analyze market data and execute trades at optimal times, maximizing returns and minimizing risks. High-frequency trading (HFT) systems use AI to make split-second decisions, capitalizing on market opportunities that are invisible to human traders. AI also enables algorithmic trading, where trades are executed based on pre-defined criteria.

AI & Process Automation

Financial institutions face numerous repetitive tasks such as data entry, account reconciliation, and report generation. RPA automates these routine processes, freeing up employees’ time for more strategic activities. Automation also ensures consistency and accuracy in financial operations.

AI in Document Management & Compliance

Managing documents and ensuring compliance with regulatory requirements can be daunting. NLP-powered AI systems can extract and analyze information from documents, flagging any discrepancies or compliance issues. It also helps maintain audit trails, making it easier to demonstrate compliance to regulators.

AI in Investment Analysis

AI enhances investment analysis by processing vast amounts of financial data and identifying trends that might be missed by human analysts. Machine learning models predict stock prices, analyze company performance, and provide investment recommendations. AI-driven robo-advisors offer personalized investment advice based on individual risk preferences and financial goals.

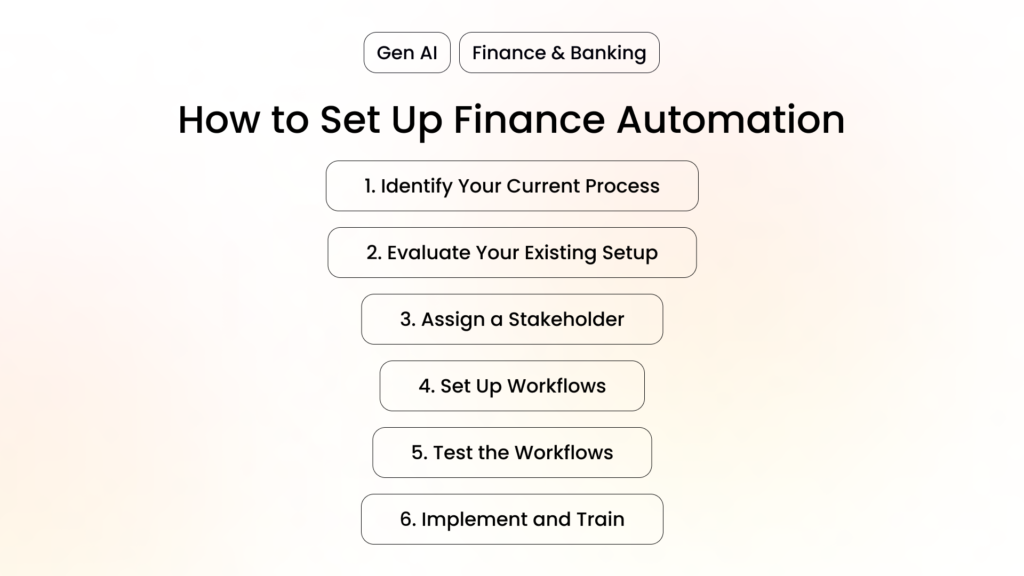

How to Set Up Finance Automation

Implementing AI automation in finance requires careful planning and execution. Here’s a step-by-step guide to setting up finance automation:

1. Identify Your Current Process

Analyze your existing financial processes in detail to identify tasks that are repetitive, time-consuming, and prone to human errors. These tasks, such as data entry, invoice processing, or report generation, are prime candidates for automation.

Creating a clear map of these processes will help in pinpointing exactly where automation can bring the most benefit.

2. Evaluate Your Existing Setup

Assess your current technology infrastructure to ensure it can support AI automation tools. This includes evaluating your software, hardware, and network capabilities. Identify any gaps or limitations, such as outdated systems or insufficient computing power, that need to be addressed before implementation.

Consider if additional investments or upgrades are necessary to create a robust foundation for AI integration.

3. Assign a Stakeholder

Assign a dedicated stakeholder or a specialized team responsible for overseeing the automation project. This team should consist of individuals with diverse expertise such as IT professionals, financial analysts, and project managers. Their role will be to coordinate efforts, manage resources effectively, ensure compliance with regulatory requirements, and monitor the project’s progress to ensure successful implementation.

4. Set Up Workflows

Design and set up detailed workflows for the identified processes. Outline each step involved and specify how AI tools will be integrated into these workflows to enhance efficiency.

Ensure that the workflows are efficient, scalable, and adaptable to future changes. Collaborate with all relevant departments to refine these workflows and make sure they align with overall business goals.

5. Test the Workflows

Conduct thorough testing of the automated workflows to ensure they function as expected under various conditions. Identify any issues, bugs, or areas for improvement and make necessary adjustments.

Testing should include stress tests, scenario-based evaluations, and user acceptance testing to ensure the system’s reliability and effectiveness. Engaging end-users in the testing phase can provide valuable feedback for further optimization.

6. Implement and Train

Once testing is complete and workflows are refined, proceed with the implementation phase. Ensure that all users are adequately trained on the new automated systems and understand how to interact with them.

Provide comprehensive documentation and support to facilitate a smooth transition. Continuous training and support will help in maximizing the benefits of AI automation, ensuring long-term success and adaptability.

Challenges of AI Automation in Finance

While AI automation offers significant benefits, there are challenges to consider:

- Implementation Costs: The initial investment in AI technology and infrastructure can be substantial, including the costs of purchasing hardware and software, and hiring skilled professionals to develop and maintain the systems.

- Data Quality: AI systems rely heavily on high-quality data to function effectively. Inaccurate, incomplete, or biased data can lead to flawed analysis and poor decision-making, undermining the potential benefits of AI solutions.

- Integration Complexity: Integrating AI tools with existing systems and processes can be complex and time-consuming. This often requires significant adjustments to current workflows and the involvement of IT professionals to ensure seamless integration.

- Regulatory Concerns: Ensuring compliance with evolving regulations and data privacy laws is critical. Organizations must stay updated with legal requirements to avoid hefty fines and protect their reputation while ensuring the ethical use of AI technologies.

- Workforce Transition: Automation and AI can lead to workforce displacement, as certain tasks may be automated. Organizations need to manage this transition by reskilling employees and redeploying them to higher-value tasks, thereby fostering a culture of continuous learning and adaptability.

The bottom line

AI automation is transforming financial processes, offering enhanced efficiency, accuracy, and decision-making capabilities. While there are challenges to overcome, the benefits of AI automation in finance are undeniable.

By understanding the technologies involved, identifying suitable use cases, and following best practices for implementation, financial institutions can harness the power of AI to drive growth and innovation.

As AI continues to evolve, its role in finance will expand, unlocking new opportunities for businesses and professionals. Integrating AI automation today positions financial institutions for a future where efficiency, precision, and innovation are paramount.

At Innovators Hub Asia, our AiLab service is your gateway to revolutionizing business operations and decision-making through advanced AI technologies. Whether you’re onboarding AI for the first time or looking to validate AI capabilities before making a large-scale investment, AiLabs offers expert guidance and custom solutions. With AiLabs, you can confidently navigate the complexities of AI and unlock new avenues of growth and efficiency.