In the rapidly evolving landscape of artificial intelligence, conversational AI stands out as a transformative force, particularly in the fields of banking and finance. This technology, which includes AI-powered chatbots and voice assistants, offers numerous benefits such as cost savings, improved customer service, and enhanced operational efficiency. As more financial institutions adopt these technologies, conversational AI is poised to become the future of banking and finance.

Customer service calls are notoriously expensive for businesses, driving many to explore cheaper channels like chatbots. However, traditional chatbots have often fallen short, and phone calls remain the preferred method for complex queries. Enter conversational AI-powered voice assistants—these advanced systems can handle intricate conversations, potentially saving businesses substantial amounts of money.

Why Text-Based Solutions Are Not Enough?

Limited Understanding

No-code chatbot platforms for banking may seem appealing but come with significant limitations. These chatbots often struggle with understanding complex questions or those phrased differently than anticipated. They rely heavily on keywords, making them ill-suited for the nuanced terminology often used in banking. This lack of understanding can lead to frustrating customer experiences and unresolved queries.

Text-Based Focus

Most traditional chatbots are built for text messaging, lacking robust voice recognition capabilities. This makes them ineffective in handling interruptions or background noise during phone calls. In contrast, conversational AI-powered voice assistants are designed to manage these challenges, offering a more seamless and natural interaction.

Customer Behavior Mismatch

Despite the growth of digital communication channels, many customers still prefer phone calls for their banking needs. Voice AI solutions can complement text-based systems, providing a comprehensive approach to customer service that meets varied preferences.

What is Conversational AI in Banking?

Conversational banking leverages chatbots, voice assistants, and messaging apps to facilitate communication between banks and their customers. Instead of calling a bank or visiting a local branch, customers can perform basic tasks through an automated system. Key functionalities include:

- Automatic Speech Recognition: Understanding human voice inputs.

- Checking Account Balances: Quick access to account information.

- Viewing Transaction Histories: Easily track spending and deposits.

- Paying Bills: Convenient bill payments without human intervention.

- Transferring Funds: Seamless money transfers between accounts.

Many major banks now offer these services through various channels:

- Mobile Apps: Integrated chatbots and voice assistants within banking apps.

- Smart Speakers: Voice commands via devices like Amazon Alexa.

- SMS Texting: Texting specific numbers to perform banking tasks.

Conversational banking through the use of chatbots and voice assistants significantly enhances the customer experience. Here’s how:

- Continuous Availability: Chatbots and voice assistants operate around the clock, ensuring assistance is available at any time, day or night. Whether it’s checking your account balance at 2 p.m. or 2 a.m., you get instant support without having to wait for business hours to contact your bank.

- Tailored Responses: AI-driven chatbots and voice assistants can deliver personalized responses by leveraging a customer’s unique account information and historical interactions with the bank. This enables them to give customized answers and suggestions, providing a more useful and engaging experience.

- Efficient and Convenient: Interacting with a chatbot or voice assistant offers unparalleled convenience. Customers can quickly get answers to their questions and perform basic tasks without the need to call or visit a bank branch.

- Ongoing Enhancement: As these chatbots and voice assistants converse with more customers, they continuously learn and improve. Utilizing machine learning and natural language processing, these tools analyze interactions to better understand various customer inquiries and ways to address them, continuously refining the user experience.

Examples of Conversational AI in Banking

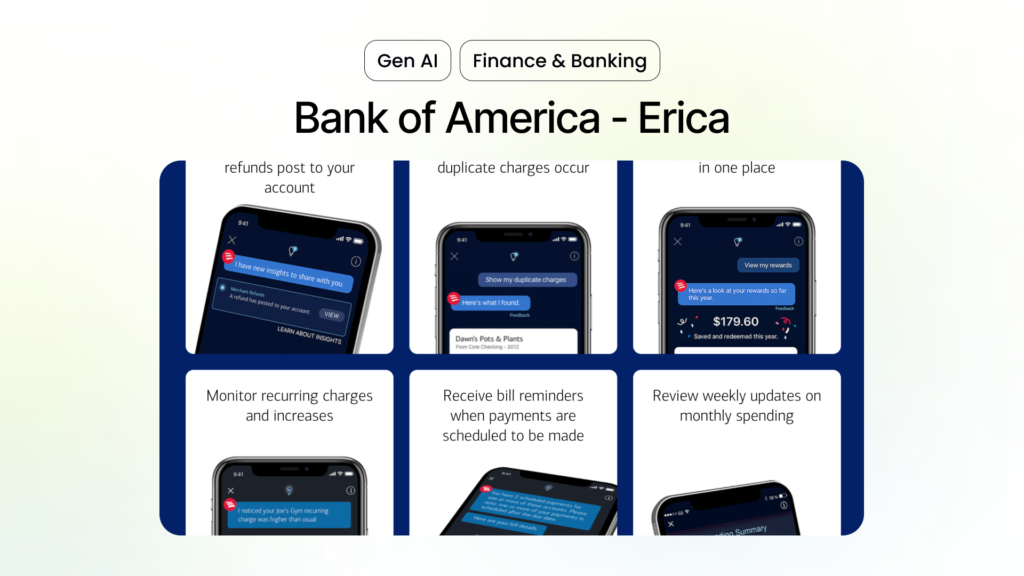

Bank of America – Erica

Launched in 2018, Erica is a chatbot integrated into Bank of America’s mobile banking app. Erica handles basic customer service queries, provides account information, pays bills, and more. It continuously evolves, expanding its capabilities based on customer interactions and feedback.

USAA – Claude

USAA, serving U.S. military members, introduced Claude in 2019. This voice assistant can answer complex questions about accounts and transactions using natural language, significantly enhancing the customer experience.

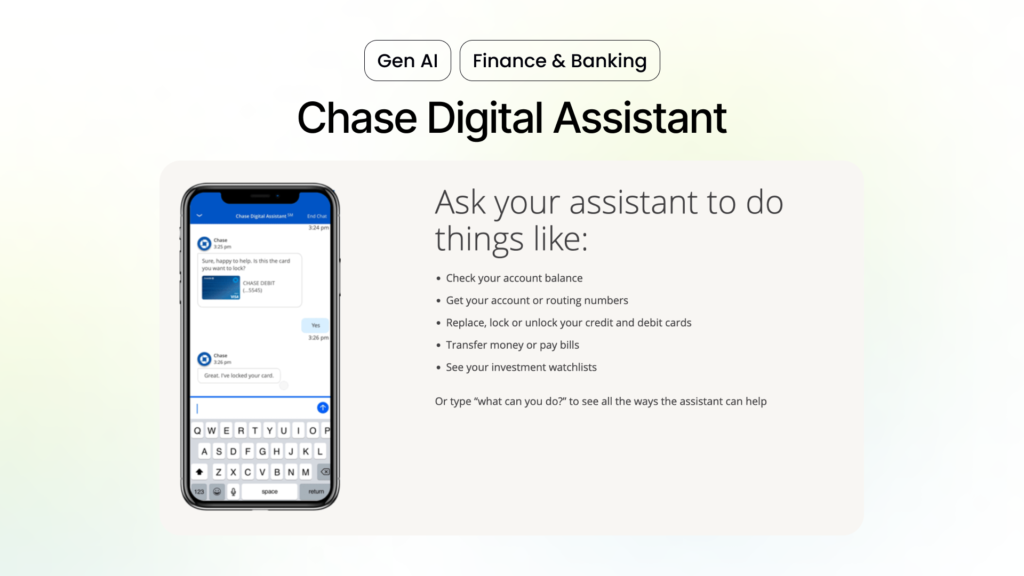

Chase Bank – Sapphire Assistant

Chase Bank’s Sapphire Assistant, unveiled in 2019, is an AI-powered chatbot that assists customers with accounts and rewards redemptions. Available 24/7 via the Chase mobile app, it provides timely support and helps customers maximize their benefits.

Other Examples of Conversational AI

- Citi Bank and Wells Fargo: Both institutions have virtual agents to handle basic customer queries.

- Smaller Banks and Credit Unions: Many partner with fintech companies to implement AI solutions and enhance digital banking experiences.

Conversational AI Trends in Banking

Advancing AI

As AI and machine learning technologies advance, conversational banking solutions will become smarter and more sophisticated. Future chatbots and voice assistants will better understand complex requests, anticipate needs, and provide personalized recommendations and advice. They may even exhibit emotional intelligence, making interactions feel more human.

Integration Across Channels

Expect conversational banking interfaces to offer a seamless experience across different channels. You might start a conversation on your mobile banking app, continue it through your smart speaker at home, and finish on your banking website. The development of AI continues to make its application smoother in conversational AI for finance.

Expanded Offerings

Banks and credit unions will likely expand conversational banking to more areas, from wealth management and bill pay to account opening and loan applications. Imagine opening a new savings account or applying for a mortgage entirely through a conversational interface.

Focus on Security

Security will remain a top priority as conversational banking advances. Strict policies, data encryption, and fraud prevention measures will help keep information private and accounts secure.

Implementing Conversational AI in Banking

The future of banking and finance is undeniably intertwined with the advancements in conversational AI. From enhancing customer service to streamlining operations, AI-driven chatbots and voice assistants are revolutionizing the industry. As these technologies become more sophisticated and integrated across various channels, they will offer even greater value to both financial institutions and their customers.

For finance professionals, fintech enthusiasts, CFOs, and fintech leaders, now is the time to explore the potential of conversational AI. By staying ahead of the curve, you can leverage this transformative technology to drive efficiency, improve customer experiences, and gain a competitive edge.