In recent years, the landscape of AI in investment and trading has undergone a significant transformation with the integration of innovative technology. AI has emerged as a powerful tool in financial markets, revolutionizing the way investors make decisions, execute trades, and manage risks.

By leveraging advanced algorithms, machine learning, and big data analytics, AI enables investors to analyze vast amounts of data, identify patterns, and make predictions with unprecedented accuracy and efficiency.

From automated trading strategies to predictive analytics, AI has become an indispensable asset for investors seeking to gain a competitive edge in today’s dynamic and fast-paced financial environment.

In this era of digital innovation, exploring the role of AI in investment and trading is essential for understanding the future of finance and its implications for market participants.

AI in stock trading

Stock trading has come a long way from the days when traders relied solely on intuition and manual research. For decades, fundamental analysis – examining a company’s intrinsic value through financial statements and industry research – was the norm. Some traders opted for technical analysis, poring over historical price and volume data to identify market trends and patterns.

However, the mid-1980s marked a turning point in trading history. The advent of personal computers revolutionized the landscape, making it easier for large investors to access real-time stock market data online. A New York Times article from 1986 highlighted how personal computers were increasingly used to obtain and act on stock market information.

While AI may seem like a novel concept, its foundational principles and related subsets have been around for over half a century. The financial industry has steadily embraced these advancements as machine learning, deep learning, and natural language processing have shown significant improvements in accuracy levels.

Today, AI has become integral to modern trading systems, offering sophisticated tools that make trading more efficient and profitable.

How AI in stock trading works

AI trading companies employ a variety of AI tools to interpret financial markets, calculate price changes, identify causes behind price fluctuations, execute trades, and monitor the ever-changing market environment. Here are several types of AI-driven trading:

Quantitative Trading (Quant Trading)

Quantitative trading utilizes quantitative modeling to analyze stock prices and volumes, identifying lucrative investment opportunities. This advanced form of trading allows investors to complete major transactions involving hundreds of thousands of shares, making it a preferred method for high-stakes investments.

Algorithmic Trading (Algo-Trading)

Algorithmic trading employs algorithms that make decisions based on historical data to execute trades. These algorithms use machine learning and deep learning to analyze market trends and financial news, executing trades in small, calculated portions to maximize returns.

High-Frequency Trading

High-frequency trading involves the rapid buying and selling of large quantities of stocks and shares. It relies on high-powered computers capable of analyzing multiple markets simultaneously and executing millions of trades within seconds, providing a competitive edge to investors.

Automated Trading (AI Trading)

Automated trading uses pre-programmed trading instructions to execute trades. Though similar to algorithmic trading, it operates on more basic strategies, offering a straightforward yet effective approach to trading.

Arbitrage Trading

Arbitrage trading exploits market inefficiencies by purchasing an asset in one market and selling it at a higher price in another. AI trading tools can monitor multiple markets simultaneously, quickly spotting price discrepancies and enabling investors to capitalize on these differences for consistent profits.

AI Trading Tools

AI-powered tools available to investors and traders serve diverse purposes, enhancing various aspects of the investment process. These sophisticated tools leverage advanced algorithms and machine learning to provide insights and automate tasks, ultimately aiming to improve investment outcomes and efficiency.

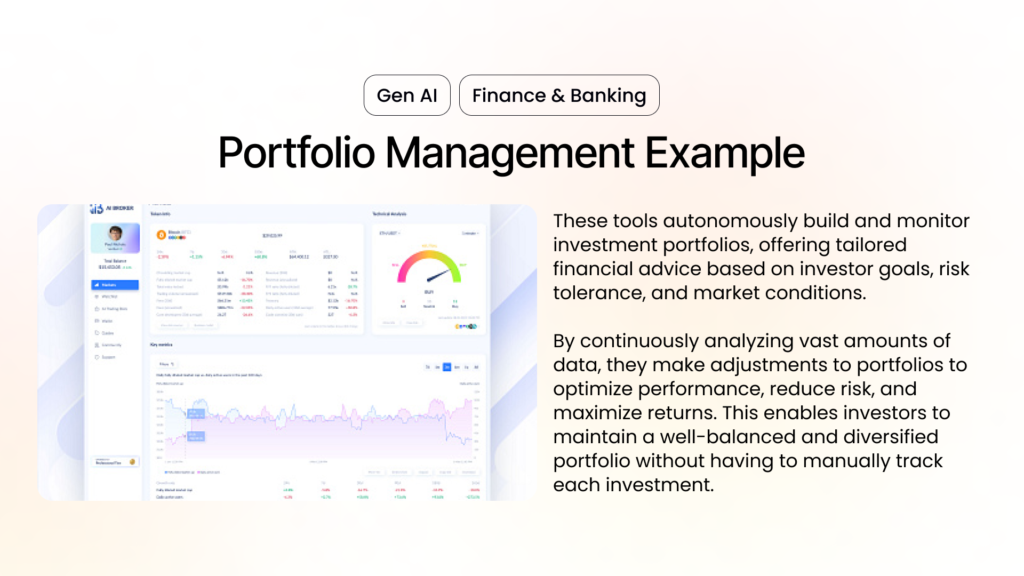

Portfolio Managers

These tools autonomously build and monitor investment portfolios, offering tailored financial advice based on investor goals, risk tolerance, and market conditions.

By continuously analyzing vast amounts of data, they make adjustments to portfolios to optimize performance, reduce risk, and maximize returns. This enables investors to maintain a well-balanced and diversified portfolio without having to manually track each investment.

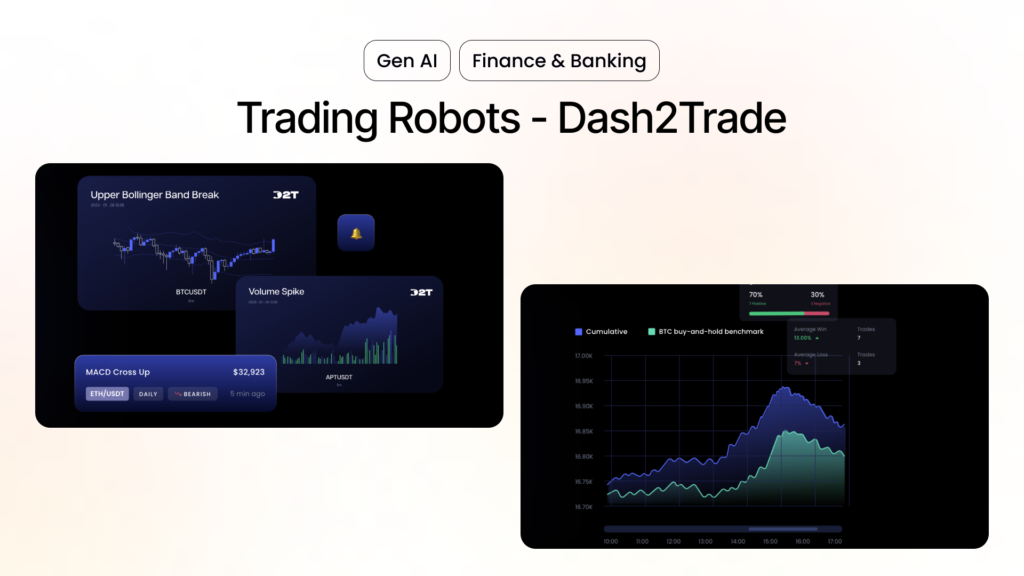

Trading Robots

Trading robots, also known as automated trading systems, are software programs that execute trades according to predetermined rules and strategies. Once installed on a trading platform, they operate independently, making swift and informed trading decisions without human intervention.

These robots can process large volumes of data in real time, identify profitable trading opportunities, and execute trades at speeds unmatched by human traders, reducing the impact of emotional decision-making and market fluctuations.

Signals

AI-generated signals alert investors when stocks or other assets meet specific criteria, enabling timely decision-making based on real-time data. These signals are derived from complex algorithms that analyze market trends, historical data, and various indicators to predict future price movements.

Investors can use these signals to make informed decisions about buying, selling, or holding assets, thereby enhancing their ability to capitalize on market opportunities and mitigate risks.

Strategy Builders

Investors can train AI strategy builders to follow personalized rules and simulate strategies in historical market conditions. This process, known as backtesting, allows investors to evaluate the potential success of their strategies before implementing them with real assets.

By refining and optimizing these strategies using historical data, investors can increase their chances of achieving desired outcomes in live trading. Additionally, AI strategy builders can continuously learn and adapt, improving their performance over time as they are exposed to new market conditions and data.

AI Contributions to the Investment Process

Data Mining: AI gathers and analyzes vast amounts of historical data, including past market prices, trading volumes, and economic indicators, to uncover hidden trends and patterns. This detailed analysis informs smarter, data-driven trading decisions, reducing guesswork and enhancing precision.

Sentiment Analysis: By analyzing online financial activity, such as news articles, social media posts, and financial reports, AI gauges market sentiment. This helps investors understand the prevailing mood of the market, guiding investment decisions to either align with or counteract current trends.

Real-Time Analysis: Algorithms scrutinize real-time data, including live stock prices, trading volumes, and global economic events, to identify emerging market patterns and trends. This facilitates faster trade executions, enabling investors to capitalize on fleeting opportunities as they arise.

Predictive Modeling: AI processes large datasets of historical market data to forecast future market behavior. By identifying potential future trends and price movements, predictive modeling helps investors plan their strategies and navigate market volatility with greater confidence.

Risk Modeling: AI creates sophisticated risk assessment models for various investment scenarios. By evaluating the probability and impact of potential risks, these models allow investors to manage and mitigate risks proactively, ensuring a more balanced and resilient portfolio.

Stress Testing: AI enables investors to test their strategies under different market conditions, such as economic downturns or market booms. This helps identify weaknesses and potential points of failure, allowing investors to fortify their financial stability by making necessary adjustments.

Backtesting: AI tests investment strategies using historical data before they are implemented in live trading. This process allows investors to refine their strategies by understanding how they would have performed under past market conditions, leading to more informed decision-making.

Benchmarking: AI helps evaluate investment strategies against market benchmarks, such as major stock indices or industry standards. This comparative analysis offers insights for continuous improvement, helping investors fine-tune their approaches to achieve better performance relative to the market.

Benefits of AI Trading

AI trading offers numerous advantages, making it an indispensable tool for modern investors and traders. Some of the key benefits include:

Reducing Research Time

AI significantly cuts down the time required for research by swiftly analyzing massive datasets and generating actionable insights. This allows investors to focus on higher-level decision-making and strategic planning, rather than getting bogged down in data collection and preliminary analysis.

By leveraging advanced algorithms and machine learning models, AI can filter out noise and highlight the most pertinent information, giving investors a clear edge in the market.

Improving Accuracy

AI enhances accuracy in trading decisions by identifying subtle market patterns and correlations that human analysts might overlook. These advanced systems are capable of processing vast amounts of data at speeds unattainable by humans, allowing for the recognition of intricate trends and anomalies. This leads to more informed and precise trading strategies, ultimately improving the chances of profitable outcomes and reducing the likelihood of errors.

Predicting Patterns

AI’s predictive capabilities enable it to forecast market trends and price movements with remarkable accuracy, helping investors stay ahead of the curve. By utilizing historical data and real-time market information, AI models can generate forecasts that predict future market behavior. This predictive power allows investors to make proactive decisions, positioning themselves advantageously in anticipation of market shifts.

Lowering Overhead Costs

Automating trading processes with AI reduces the need for extensive human resources, thereby lowering operational costs. Additionally, AI-driven efficiency minimizes errors, further cutting down expenses. By streamlining operations and reducing the reliance on manual intervention, companies can achieve significant cost savings.

Moreover, AI systems can operate around the clock, ensuring that trading opportunities are never missed, further enhancing profitability.

Enhancing Portfolio Management

AI tools optimize portfolio management by continuously monitoring market conditions and adjusting investments in real time, ensuring optimal asset allocation and risk management.

These tools can balance various asset classes, rebalance portfolios as needed, and implement adaptive strategies to respond to market changes. By providing a dynamic and responsive approach to portfolio management, AI helps investors achieve better returns while minimizing risk exposure.

Increasing Market Accessibility

AI democratizes access to advanced trading strategies, making them available to a broader range of investors, regardless of their experience level. By providing user-friendly platforms and tools, AI lowers the barrier to entry, allowing novice investors to benefit from sophisticated strategies that were once the domain of seasoned professionals. This increased accessibility fosters greater market participation and can lead to more inclusive economic growth.

Facilitating Real-Time Decision Making

AI’s ability to process and analyze data in real time empowers investors to make swift and informed decisions, capitalizing on market opportunities as they arise. With access to up-to-the-minute information and instantaneous analysis, investors can respond to market developments with unprecedented speed and accuracy. This capability is crucial in fast-moving markets where timing can be the difference between profit and loss.

Managing Risk Proactively

AI-driven risk modeling and stress testing allow investors to anticipate potential risks and devise strategies to mitigate them effectively. By simulating various market scenarios and assessing their impact on portfolios, AI can identify vulnerabilities and recommend protective measures. This proactive approach to risk management helps investors safeguard their assets and maintain stability even in volatile market conditions.

Enabling Continuous Improvement

Through benchmarking and backtesting, AI helps investors continually refine and improve their trading strategies, leading to better long-term performance. By rigorously testing strategies against historical data and comparing results to market benchmarks, AI can identify strengths and weaknesses, offering insights for enhancement.

This iterative process of continuous improvement ensures that trading approaches remain effective and evolve with changing market dynamics.

Conclusion

The integration of AI in investment and trading represents a significant leap forward for the financial industry. By automating complex processes, enhancing decision-making accuracy, and offering powerful tools to manage risk and optimize portfolios, AI is transforming how traders and investors navigate the financial markets.

As AI continues to evolve, its applications in trading and investment will only become more sophisticated and accessible. For traders and investors looking to stay competitive and capitalize on the opportunities AI offers, embracing this technology is not just an option – it’s a necessity.