AI has become a dominant force in the technological landscape, revolutionizing business operations across various sectors. In particular, AI in finance and banking, where AI and Gen AI technologies are central to operational advancements. The integration of AI into finance has led to the development of sophisticated tools and systems that enhance efficiency, security, and customer experience.

The finance sector, traditionally seen as a bastion of conservative practices, is now at the forefront of technological innovation, thanks to AI. From algorithmic trading and fraud detection to personalized banking services and risk management, the applications of AI in finance are vast and varied.

Generative AI, a subset of AI focused on creating new content and solutions, further extends these capabilities by generating financial models, market analysis, and even predictive forecasting, offering unprecedented insights and opportunities for growth.

This blog post explores the transformative power of AI and Generative AI in finance. We’ll look at their current uses, highlighting how they’re reshaping financial services. We’ll also consider future developments, imagining a world with even greater AI impact on finance.

Furthermore, we’ll provide tips for finance professionals to stay ahead in this fast-changing field, ensuring they leverage technology to redefine finance’s future. Join us as we uncover the potential of AI and Generative AI in finance.

What is Artificial Intelligence?

Artificial Intelligence (AI) is the simulation of human intelligence in machines programmed to think and learn like humans. AI encompasses various subfields, including Machine Learning (ML) and Natural Language Processing (NLP), which are particularly relevant to financial services.

- Machine Learning (ML): Machine Learning involves the intricate development of algorithms and statistical models that empower computers to perform tasks without explicit instructions. By analyzing patterns and data, these systems learn from past experiences, allowing them to make informed decisions and predictions, enhancing their performance over time.

- Natural Language Processing (NLP): Natural Language Processing is a branch of artificial intelligence that focuses on the interaction between computers and humans through natural language. NLP technology enables machines to read, decipher, understand, and make sense of human languages in a valuable way. This capability allows for a range of applications, from sentiment analysis, which interprets and categorizes the emotion expressed in text, to automated report generation, streamlining the creation of summaries or data-driven reports without manual effort.

Generative AI (Gen AI): A Subset of AI

Gen AI, a remarkable subset of artificial intelligence, concentrates on generating new content across different formats. This technology can create text, code, images, and much more, positioning it as a versatile and invaluable tool for a plethora of applications in the finance sector.

- Text Generation: This facet of generative AI involves creating detailed financial reports, comprehensive summaries, and various forms of documentation. It streamlines the process of compiling complex financial data into understandable formats, saving significant time and resources.

- Code Creation: Another powerful application of generative AI is in automating the development of sophisticated trading algorithms and risk management tools. This not only enhances the efficiency of financial operations but also introduces innovative approaches to handling financial data and decision-making processes.

- Customizing Marketing Materials: By harnessing generative AI, finance companies can now personalize their communication with clients like never before. This technology allows for the customization of marketing materials based on individual client preferences and behaviors, thereby increasing engagement and improving client relationships.

Through these applications, generative AI is redefining the landscape of the finance industry, offering unprecedented opportunities for innovation and efficiency.

AI in Finance and Banking

AI and Generative AI are revolutionizing financial services by automating processes, enhancing decision-making, and providing personalized experiences. The report shows that at the moment, 32% of financial service providers are already using AI and AI can automate 20% of banking and financial activities, reducing operational costs by 22% around 2030.

This indicates a notable shift in the banking sector towards the deployment of AI to boost efficiency, provide tailored services, and enrich customer interactions. Financial institutions are likely gearing up to deploy AI-driven chatbots, voice assistants, and data analysis tools. The goal is to deeply comprehend and cater to client requirements, delivering smoother and more efficient customer support.

Use Cases of AI and Gen AI in Finance and Banking

1. Compliance: Fraud Detection and Anti-Money Laundering (AML) Monitoring

AI systems can analyze vast amounts of transaction data to identify patterns indicative of fraudulent activity or money laundering. Machine Learning algorithms continuously improve their detection capabilities, making compliance more robust.

2. Risk Management: Alerting Risk Managers to Potentially Unacceptable Risks

AI can assess market conditions and predict potential risks, alerting risk managers to take preemptive actions. This proactive approach helps mitigate financial losses and enhances the stability of financial institutions.

3. Consumer Banking: Improve Time- and Cost-Efficiency Through Chatbots

AI-powered chatbots provide instant customer support, handling queries related to account balances, transaction history, and more. This improves customer experience while reducing operational costs.

4. Wealth Management: Helping Wealth Managers Create Tailored Solutions for Clients

AI analyzes client data to provide wealth managers with actionable insights, enabling them to create personalized investment strategies that align with their client’s financial goals and risk tolerance.

5. Investment Banking: Identifying Companies for Capital Raising or Acquisitions

AI algorithms can sift through financial data to identify companies that need to raise capital or are suitable candidates for mergers and acquisitions, streamlining the deal-making process.

6. Trading: Algorithmic Trading Strategies and Sentiment Analysis

AI-driven trading algorithms execute trades based on real-time data, optimizing investment returns. Sentiment analysis of news and social media provides additional signals to inform trading decisions.

The Future of AI in Finance and Banking

1. Enhanced Personalization in Customer Service

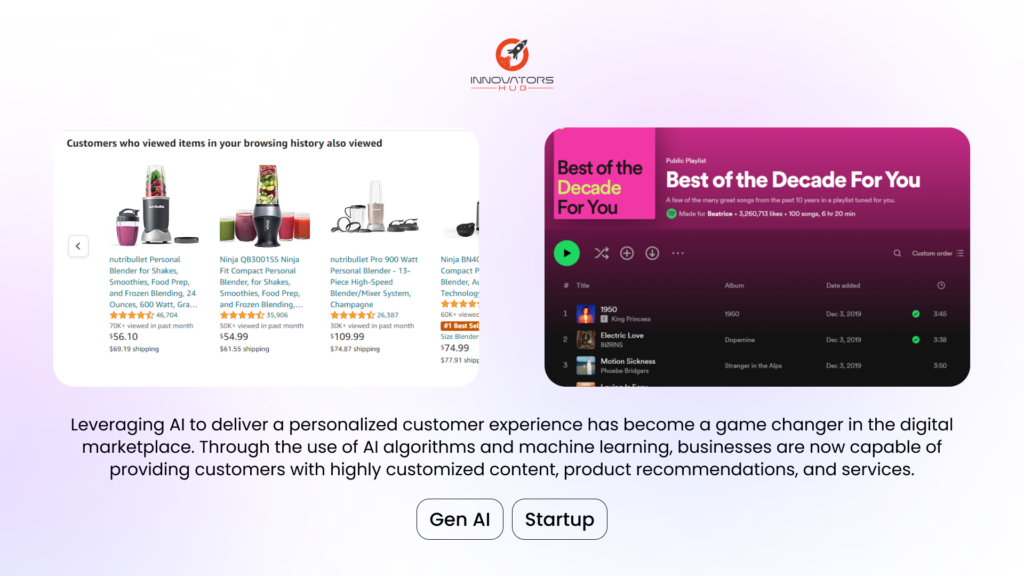

The future of AI in finance and banking promises even more personalized customer service experiences. AI can analyze customer behavior and preferences in real time, delivering tailored products and services that meet individual needs. From customized loan offers to personalized financial advice, the ability to understand and respond to specific customer requirements can significantly improve satisfaction and loyalty.

2. Improved Fraud Detection and Cybersecurity

As cyber threats become more sophisticated, the role of AI in fraud detection and cybersecurity will become crucial. AI systems can continuously monitor transactions and digital interactions, identifying and responding to anomalies that might indicate fraudulent activities. Advanced machine learning models can adapt to new patterns of fraud, providing a dynamic defense mechanism that evolves alongside emerging threats.

3. Regulatory Compliance and Reporting

AI can also play a pivotal role in ensuring regulatory compliance and simplifying reporting processes. Automated systems can review transactions, flag potential compliance issues, and prepare reports with high accuracy and speed. This not only reduces the risk of non-compliance but also decreases the administrative burden on financial institutions, allowing them to focus more on client-facing activities and strategic initiatives.

4. Financial Inclusion

One of the most transformative impacts of AI in finance may be its potential to enhance financial inclusion. AI-driven solutions can provide banking services to underserved populations by leveraging alternative data sources to assess creditworthiness, thus facilitating access to credit and other financial products. Mobile banking and AI-powered financial tools can reach remote areas where traditional banking infrastructure is lacking, bridging the gap between different socio-economic groups.

How Finance Professionals Can Thrive With AI in Finance and Banking

1. Lifelong Learning and Professional Development

To stay relevant in the rapidly evolving world of AI and generative AI, finance professionals must commit to lifelong learning and continuous professional development. This involves not only understanding the fundamentals of AI but also keeping abreast of the latest advancements and applications in the financial sector.

Enrolling in specialized courses, attending industry conferences, and participating in webinars are effective ways to acquire up-to-date knowledge and skills. Additionally, joining professional networks and forums can provide valuable opportunities for collaboration and knowledge sharing with peers and experts in the field.

2. Collaborating with AI Experts

Collaboration between finance professionals and AI experts is essential for the successful implementation of AI-driven solutions. Interdisciplinary teams can provide a comprehensive perspective, combining financial expertise with deep technical knowledge to develop innovative strategies and tools.

Finance professionals should seek to build strong relationships with data scientists, machine learning engineers, and AI researchers to ensure that the AI applications are both effective and aligned with regulatory and ethical standards. By fostering a collaborative environment, financial institutions can enhance the utility and impact of AI technologies in their operations.

3. Ethical Considerations and Responsible AI

As AI becomes more integral to financial services, it is imperative to address ethical considerations and ensure the responsible use of these technologies. Finance professionals must be vigilant about the potential risks associated with AI, such as biases in algorithms, data privacy concerns, and the implications of automated decision-making.

Developing and adhering to ethical guidelines and best practices for AI deployment is crucial. By prioritizing transparency, fairness, and accountability, the financial industry can build trust and safeguard the interests of all stakeholders.

Integrating AI in Finance and Banking

AI and Gen AI are transforming the finance and banking sectors, offering numerous benefits from increased efficiency to improved decision-making. By understanding their potential, staying updated with the latest advancements, and adopting an AI mindset, financial professionals can leverage these technologies to drive innovation and maintain a competitive edge.

Ready to explore the transformative power of AI in finance? Contact Innovators Hub Asia today to learn how AI deployment in your business can drive significant growth.

At Innovators Hub Asia, our AiLab service is your gateway to revolutionizing business operations and decision-making through advanced AI technologies. As a leading AI consulting firm, AiLabs provides a comprehensive suite of services that include crafting bespoke AI strategies, prototyping concepts, and implementing full-scale AI systems tailored to your organization’s unique needs.

Whether you’re onboarding AI for the first time or looking to validate AI capabilities before making a large-scale investment, AiLabs offers expert guidance and custom solutions. With AiLabs, you can confidently navigate the complexities of AI and unlock new avenues of growth and efficiency.